Budget and Spend Management

📄 Summary: What You’ll Learn in This Article

This article provides an overview of how Marmind supports budget and spend management. Learn how to plan budgets, track costs, manage actuals, and optimize financial workflows using Marmind’s powerful budgeting and cost management tools.

Planning and allocating budgets

Tracking costs, creating actuals, and monitoring financial performance

Adjusting budgets and costs

Using the Budget & Cost Grid for real-time financial insights

Automating budget workflows

🧑🤝🧑 Who Should Read This?

This article is most useful for:

Marketing Professionals, Marketing Operations Managers, Business leaders who are interested in Marmind’s features

New Marmind Users

✔️ Prerequisites: What Should You Know Before Getting Started?

Level: Easy

Access required: None

No prior knowledge is required. This is an introductory article for those exploring Marmind for the first time.

Managing Budgets with Marmind

Marmind enables structured budget planning using both top-down and bottom-up approaches:

Top-down planning: Assign budgets at the highest level (e.g., market level) and allocate them down to campaigns and projects.

Bottom-up planning: Plan at the project or campaign level and roll up totals to provide an overall budget estimate.

Define budget groups to categorize different budget types.

Set up currencies and exchange rates to manage international budgets.

Establish planning areas and periods for structured financial management.

.jpg?inst-v=bc589951-8848-4fb4-bb38-b8b1df05edb5)

Costs

Tracking Costs and Actuals

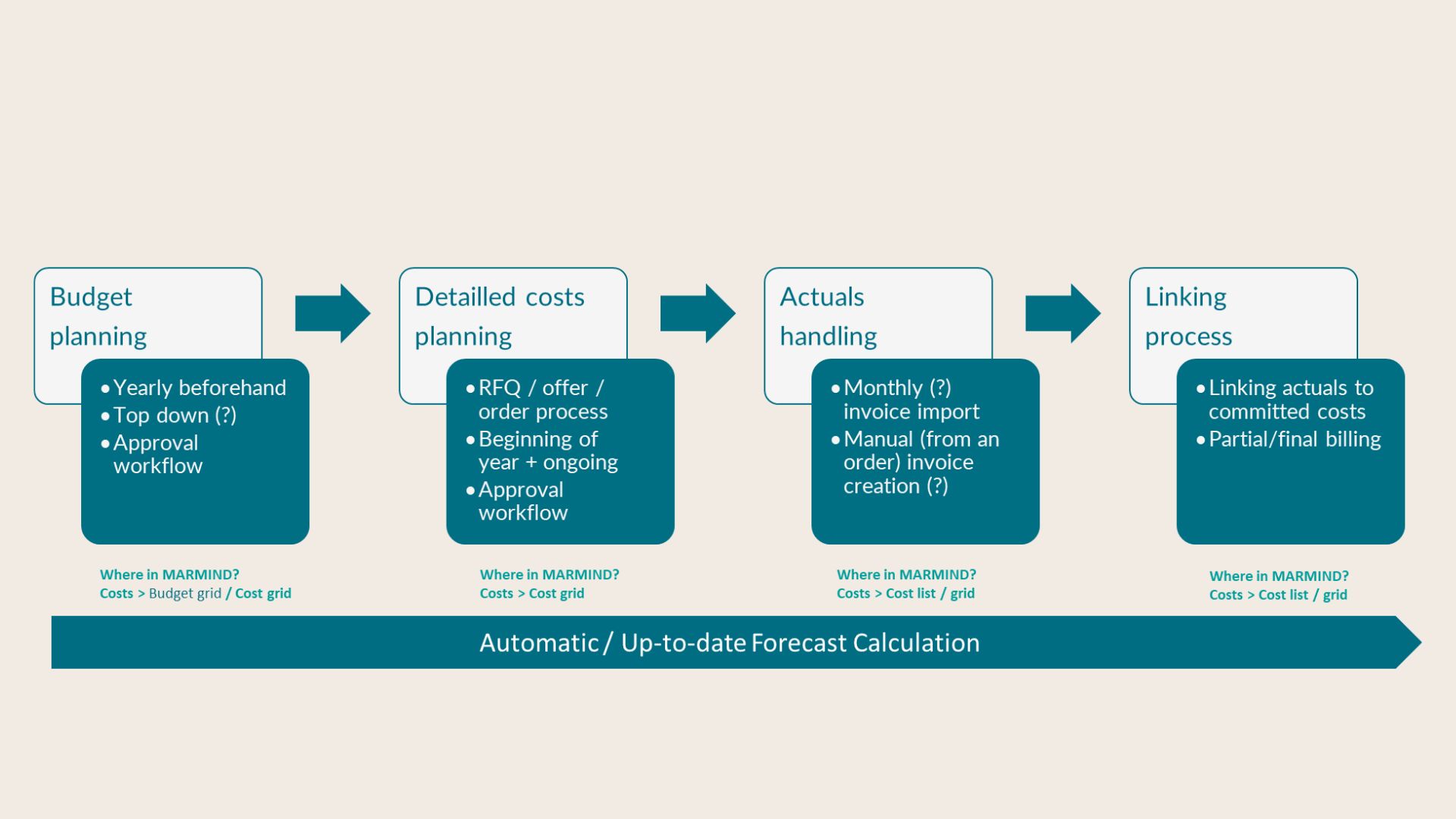

Marmind provides comprehensive tools for tracking costs throughout the financial cycle:

Planned Costs: Define estimated expenses per campaign, project, or department.

Committed Costs: Lock in costs once contracts or agreements are confirmed.

Actual Costs: Log real expenses, ensuring accurate financial reporting.

Cost Splitting: Allocate costs across multiple months or periods to match spending timelines.

Managing Cost Adjustments

Marmind is able to keep track of planned, contracted, and actual costs, and creates automated forecasts to know if you're on budget at all times.

Budget & Costs Process

Marmind allows users to adjust costs dynamically:

Shifting Cost Splits: Move costs across periods when campaigns change timelines.

Bulk Cost Shifting: Adjust multiple planned costs simultaneously to a new period.

Canceling Costs: Remove unnecessary planned costs without losing financial history.

Recurring Costs: Automate cost entries for repeating expenses, such as monthly subscriptions.

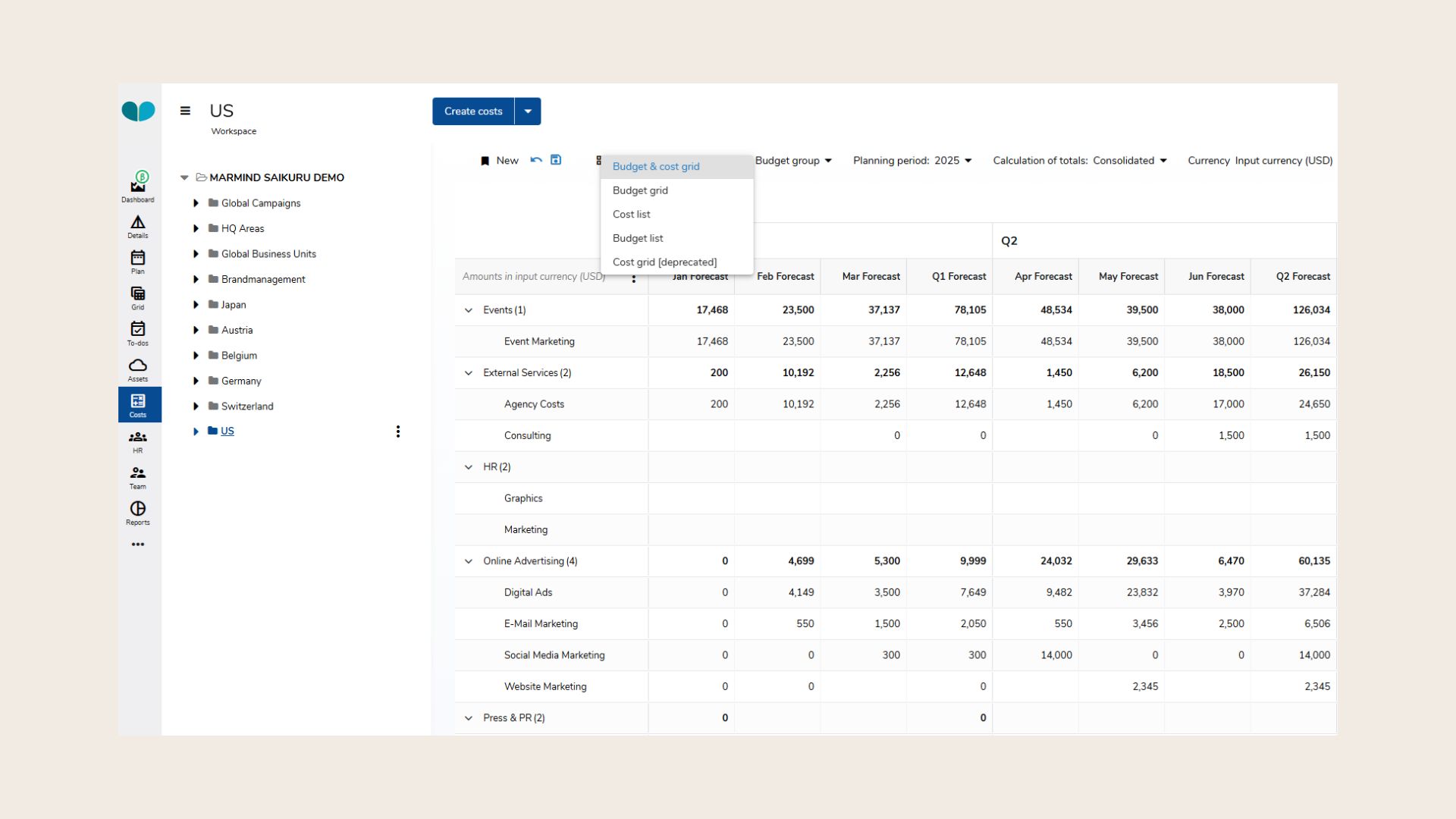

The Budget & Cost Grid

The Budget & Cost Grid in Marmind provides a real-time financial dashboard to:

Compare planned budgets against any expenses.

Customize displayed columns for different planning periods (e.g., last year, current year, next year).

Use Tree View to track budgets across campaigns and projects.

Apply filters to analyze financial data efficiently.

Switch between currencies for better financial reporting.

Budget & Cost Grid

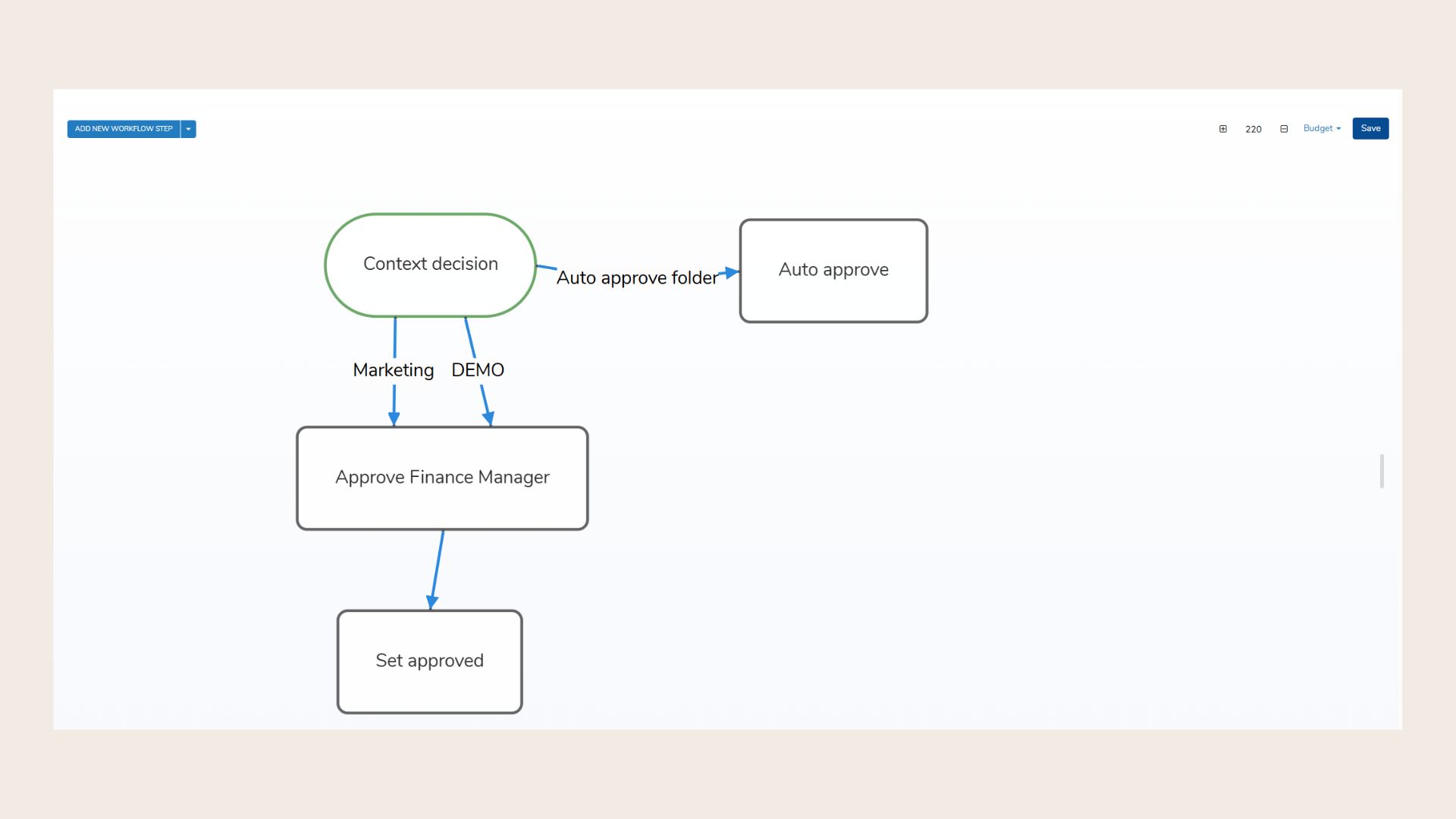

Automating Budget Workflows

Marmind helps reduce manual effort by automating budget workflows:

Approval Processes: Set up structured approvals for budget allocations and expenses.

Notifications & Alerts: Get notified of budget updates, overages, or financial changes.

Financial Reports: Generate detailed reports to analyze spending efficiency.

Budget Workflow